- Dapatkan link

- X

- Aplikasi Lainnya

- Dapatkan link

- X

- Aplikasi Lainnya

And for intermediate-term bonds 482 and 315. Lincoln Stable Value Separate Account Lincoln Financial Group is a premier provider of stable value solutions and has offered risk management expertise financial strength and attractive contract provisions to defined contribution plan sponsors and participants for over 30 years.

The Lincoln Stable Value Account is a fixed annuity contract issued by The Lincoln National Life Insurance Company Fort Wayne IN 46802 on Form 28866-SV 0101 28866-SV20 0504 28866-SV90 0504 AN 700 0112 or AR 700 1009.

Lincoln stable value yield. Benefit Composite Employee Hand Trust - HbandT Lincoln Stable Value CIF HLSVAX Nasdaq - Nasdaq Delayed Price. 05282021 1200 AM NAV. 1031 000 000 At.

Stable value funds which yield 29. But investors in 401 k plans have a richer alternative. Treasury 4165 6319 Agency 018 560 Other Govt Related 057 498 Corporate 2775 2624 MBS 815 000 ABS 567 000 CMBS 846 000 CMO 671 000 Cash Net Other Assets 086 000 Total 10000 10000.

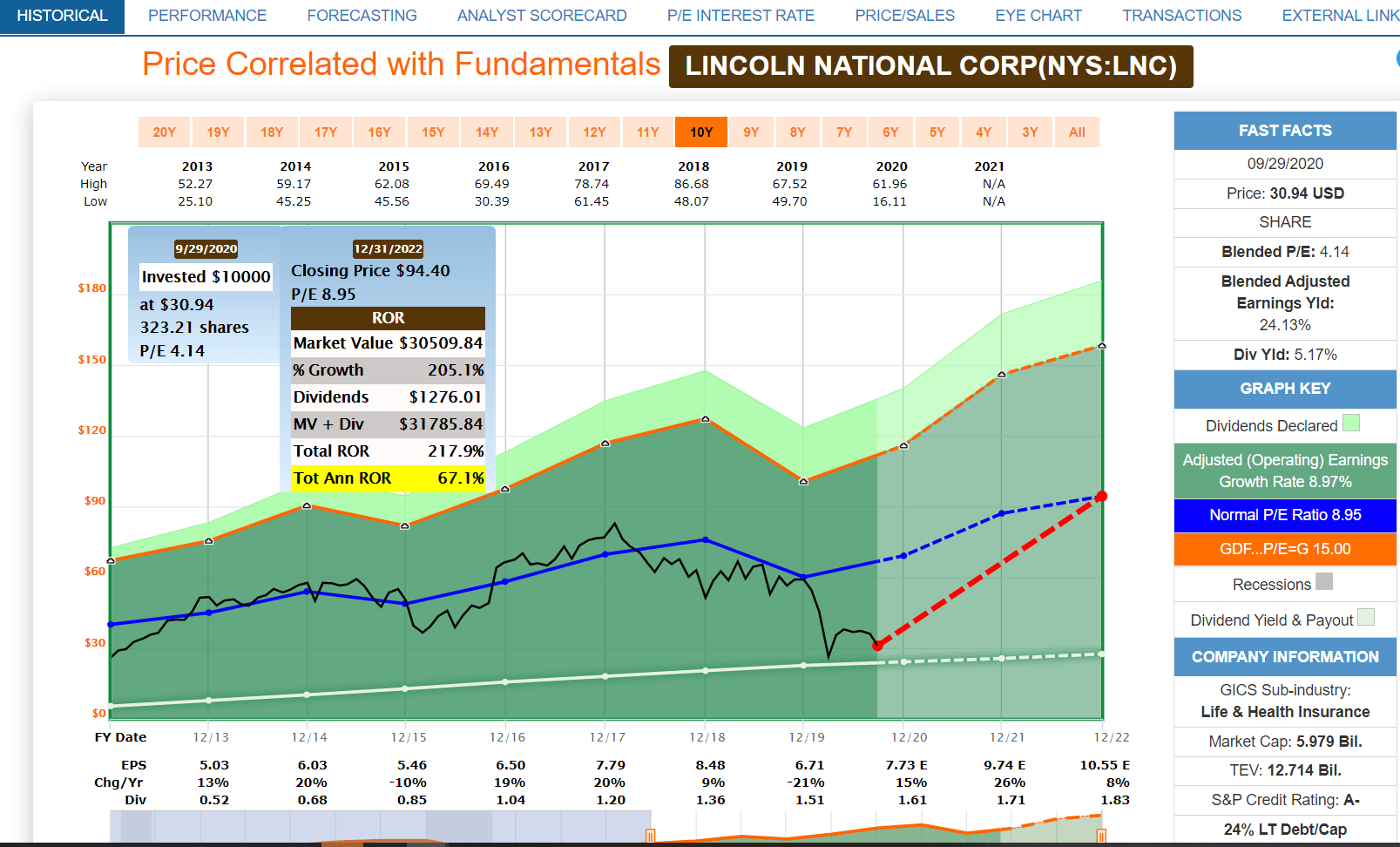

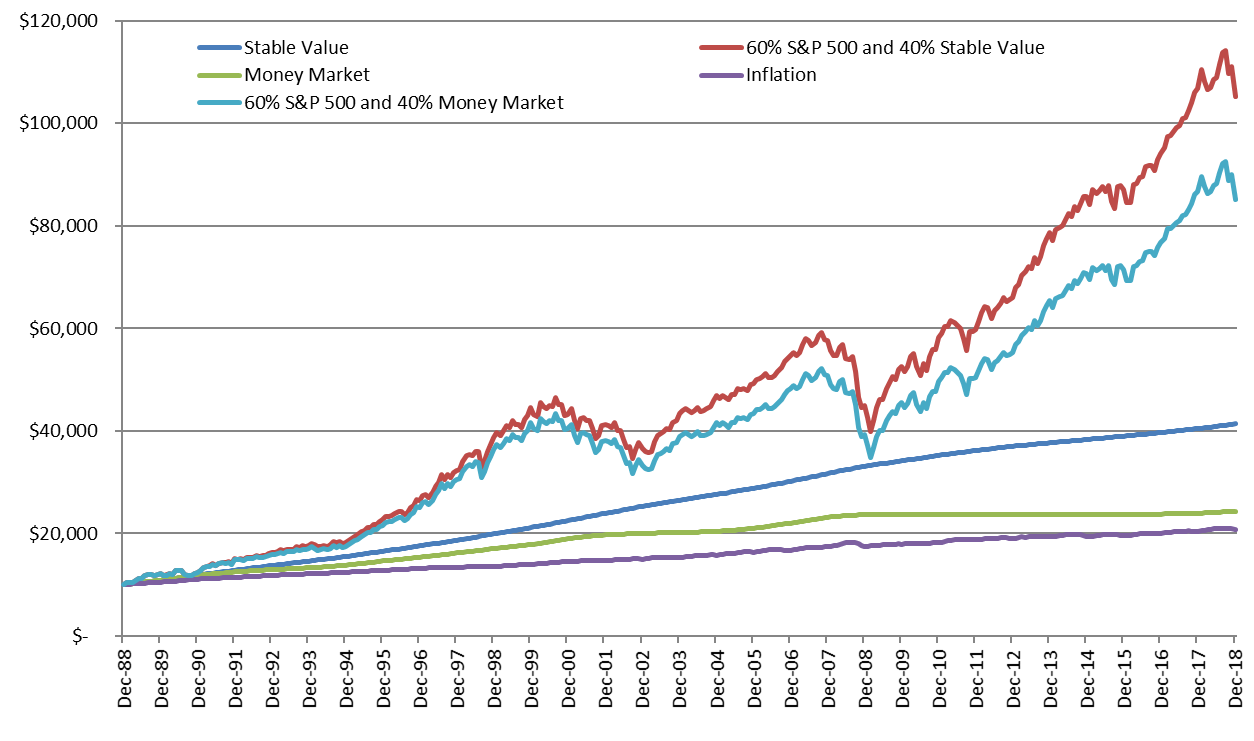

With its built-in stability yield and liquidity a stable value investment can be ideal for any defined contribution retirement plan looking for a sound conservative investment option. Current Fixed Rate The portfolio interest rate for the Lincoln Stable Value Account this quarter is 493. With stable value funds rates typically above inflation they can play an important role in a participants portfolio Ralph Ferraro senior vice president head of product retirement plan services at Lincoln Financial Group in Radnor Pennsylvania says performance data from the past 30 years bears out stable value funds outperformance.

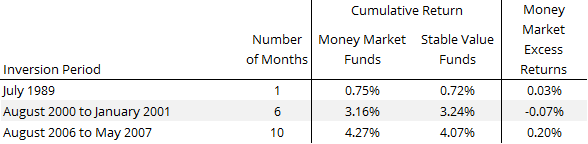

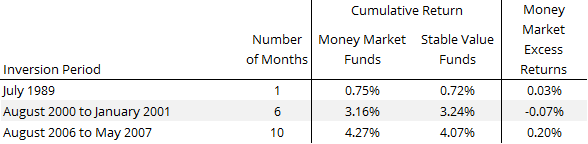

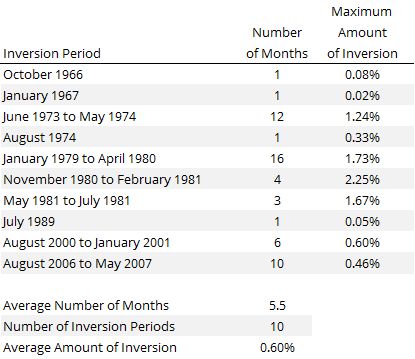

Stable value investments and money market funds often have similar investment objectives. A stable value investment is a relatively low-risk investment that is only available to retirement plan participants. A steep yield curve is generally more favorable for stable value funds because their portfolios are longer in duration taking advantage of the term premium imbedded in the yield.

Stable Value investments vs. Approach to stable value asset management. The Lincoln Stable Value Option is managed to earn a competitive interest rate without risking a loss of principal.

For plan sponsor use only. Lincoln has the financial strength to provide interest guarantees and benefit liquidity and is committed to the stable value asset class. Money market mutual funds Lincoln Stable Value investments offer stability liquidity and yield.

Based on the type of stable investment. For money-market funds the average total return was 193 with a standard deviation of 208. Guarantees for the Lincoln Fixed Annuity are subject to the claims-paying ability of the issuer.

2076918 Page 1 of 2 Contact your Lincoln Financial representative to learn more about the Lincoln Stable Value Account. Stable Value BBgBarc 1-5 GC A Duration yrs 272 271 Yield 077 054 PORTFOLIO CHARACTERISTICS Stable Value BBgBarc 1-5 GC A US. Add instrument to watchlist.

Metropolitan West High Yield Bond I7 PIMCO Total Return I2 Templeton Global Bond Adv Vanguard Interm-Term Bond Index Adm Cash and stable value investments American Funds US Government MMkt R43 Lincoln Stable Value Account - LNTPA13 Mutual fund investment options disclosures. Our risk-controlled approach to stable value management offers an attractive solution for plan sponsors and participants seeking stability liquidity yield and principal protection. Lincoln Stable Value Account Lincoln Financial Group is a premier provider of stable value solutions and has offered risk management expertise financial strength and attractive contract provisions to defined contribution plan sponsors and participants for over 30 years.

Current interest rates on stable value investments are provided by the issuing insurance company. Lincoln Stable Value solutions are offered as part of our bundled full service or investment-only service for defined contribution plans. To find out how Lincoln Stable Value solutions can help you support positive retirement outcomes call our Sales Desk at 855-533-2170.

Guarantees for the Lincoln Stable Value Account are subject to the claims-paying ability of the issuer. The Lincoln Stable Value Account is a fixed annuity issued by The Lincoln National Life Insurance Company Fort Wayne IN. Our white paper covers stable value basics explains the growth of this options popularity clarifies common terminology compares stable value with money market funds and discusses how you can achieve success in this.

In recent years stable value funds have served as. Today the most commonly used type of contract in stable value funds is the synthetic GIC and from 1999 through 2014 stable value funds averaged a total return of 435 with a standard deviation of 123. It typically has an investment objective of capital preservation liquidity and yield.

See how they can provide an attractive alternative to money market mutual funds. 13 The Lincoln Stable Value Account is a fixed annuity contract issued by The Lincoln National Life Insurance Company Fort Wayne IN 46802 on Form 28866-SV 0101 28866-SV20 0504 28866-SV90 0504 AN 700 0112 or AR 700 1009. 289 rows Lincoln Stable Value Account LNGXA.

The Lincoln Stable Value Account offers the following features. You can rely on Lincoln as an experienced provider of stable value asset management.

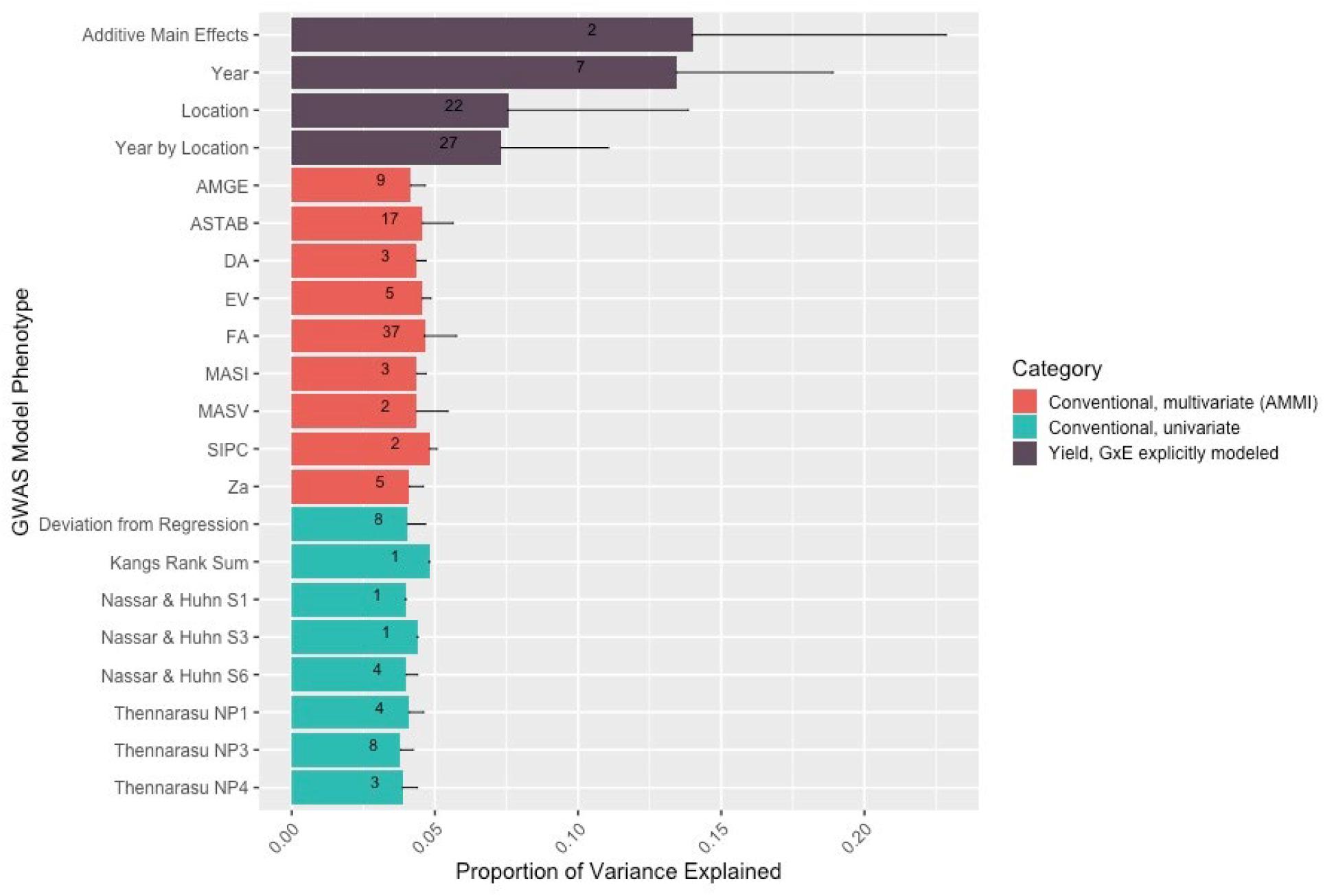

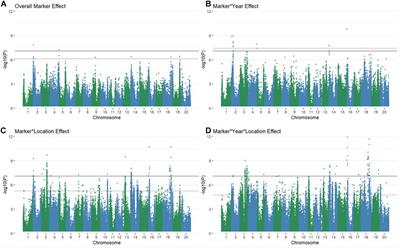

Frontiers Comparing A Mixed Model Approach To Traditional Stability Estimators For Mapping Genotype By Environment Interactions And Yield Stability In Soybean Glycine Max L Merr Plant Science

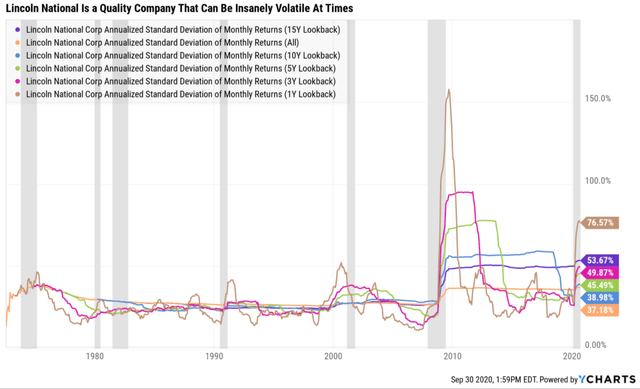

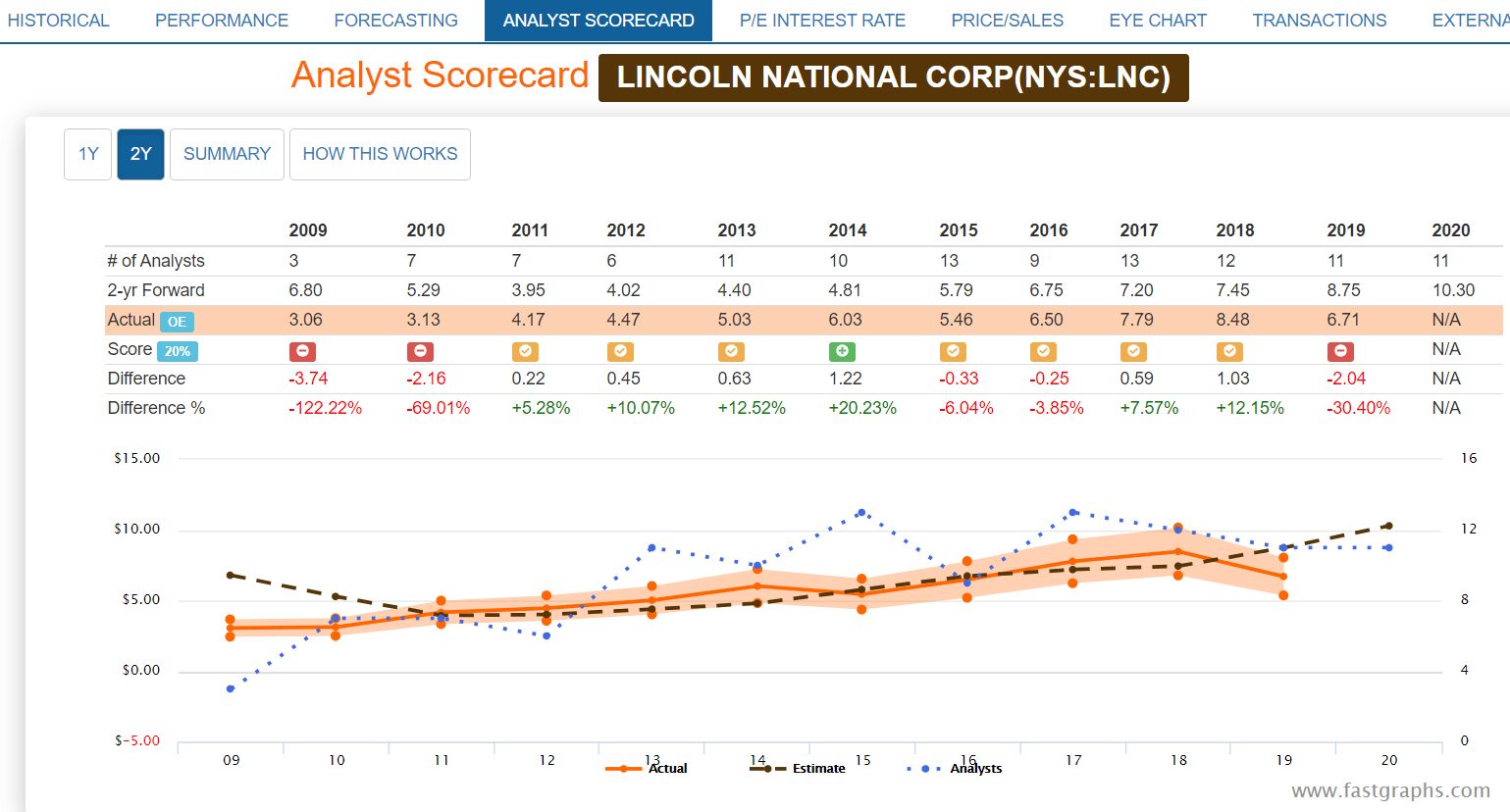

3 Fast Growing High Yield Dividend Stocks That Are Outrageously Undervalued Seeking Alpha

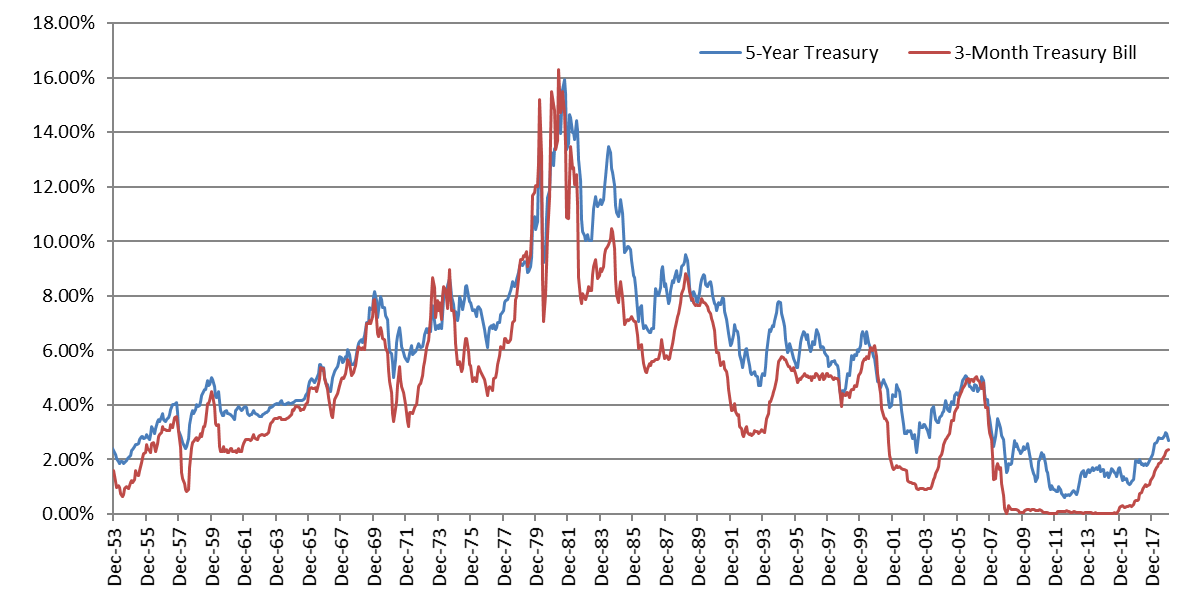

Stable Value And Rising Interest Rates Stable Value

Frontiers Comparing A Mixed Model Approach To Traditional Stability Estimators For Mapping Genotype By Environment Interactions And Yield Stability In Soybean Glycine Max L Merr Plant Science

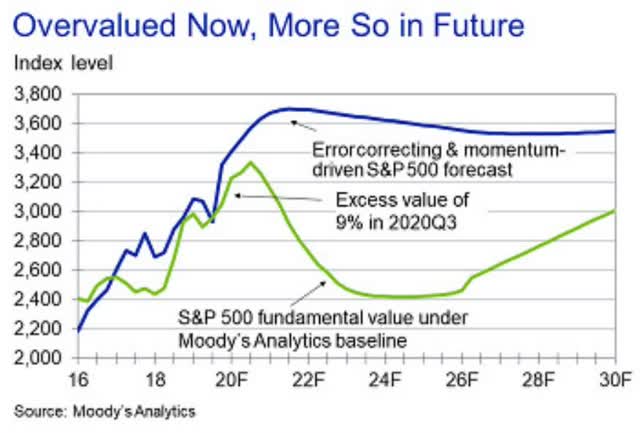

Private Credit 2021 Outlook A Steady Ship In Choppy Waters

3 Fast Growing High Yield Dividend Stocks That Are Outrageously Undervalued Seeking Alpha

What Is A Stable Value Fund Forbes Advisor

Why Stable Value Funds Deserve A Closer Look

Stable Value And Rising Interest Rates Stable Value

3 Fast Growing High Yield Dividend Stocks That Are Outrageously Undervalued Seeking Alpha

Https Retirementservices Bpas Com Funds Fshlsvi Pdf

Stable Value And Rising Interest Rates Stable Value

Private Credit 2021 Outlook A Steady Ship In Choppy Waters

3 Fast Growing High Yield Dividend Stocks That Are Outrageously Undervalued Seeking Alpha

Stable Value And Rising Interest Rates Stable Value

Komentar

Posting Komentar